Texas

Invoice Factoring Office

Riviera Finance’s Texas invoice factoring office provides cash flow solutions to businesses in all of Texas and surrounding areas.

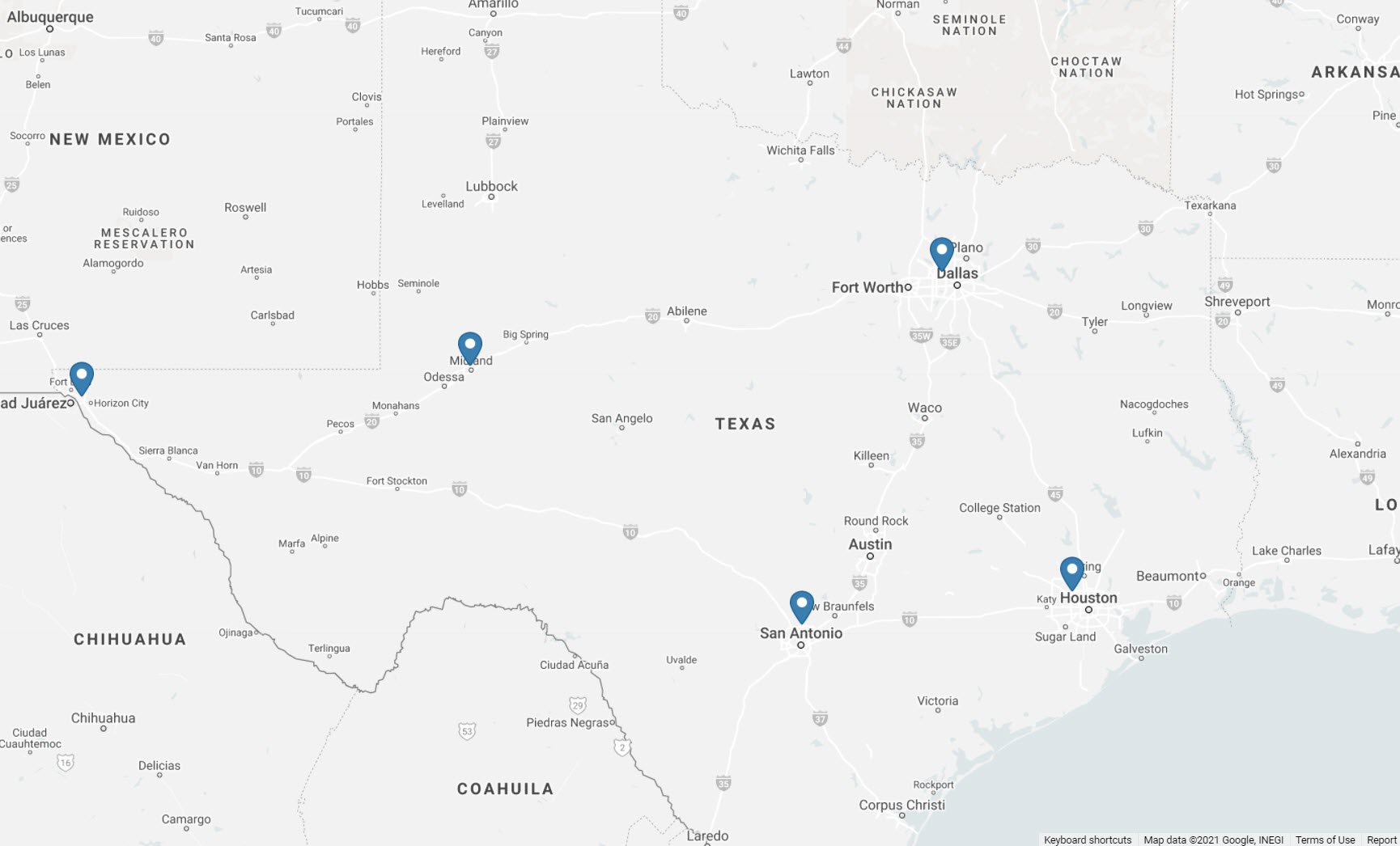

Riviera Finance offers invoice factoring and other financial services for businesses in El Paso, Midland, San Antonio, Dallas, Houston, and throughout the entire state of Texas. Invoice factoring is an attractive finance option for any business that wants to improve cash flow and reduce the problems associated with collections and waiting for customers to pay invoices.

Working Capital Made Simple

Riviera Finance offers working capital solutions for businesses to improve cash flow and continue business growth throughout Texas. Our team is ready to move quickly for you in order to solve cash flow problems you may be experiencing and get you the relief you need.

The Riviera Advantage

Non-Recourse

We take the credit risk on all the invoices we factor

Flexible

You select which invoices to factor

Personal Service

Dedicated account team with direct contact

Get Started

Complete the form for a Free Consultation.

Invoice Factoring in Texas Services

Riviera Finance offers the following financial services to help business owners in Texas. Find out how some of the alternative financing options can help your business manage cash flow and grow this year.

Why Choose Riviera Finance as Your Invoice Factoring Company in Texas?

If you’re seeking and invoice factoring company in Texas it’s important to find the right company to work with. Riviera Finance is an invoice factoring company that is the industry leader in providing financing to businesses throughout the U.S. and Canada. See our full list of invoice factoring offices.

Experience

Riviera has been offering factoring and other financial services for ore than 50 years. We have a solid reputation with countless satisfied customers.

Convenience

With more than 25 invoice factoring offices in the United States and Canada, we have more than 200 team members who process invoices, approve credit and wire funds to our clients.

Get Maximum Cash Advances

Riviera Finance pays the highest cash advances on invoices in the industry, so you can have more money to run and grow your business.

Customer Friendly Policies

We make it as easy as possible to set up your account and start collecting payment on your invoices. You will work with a dedicated team from start to finish.

Simplicity

All you do is submit your unpaid invoices and Riviera handles mailing, verification and collections. No long-term contracts or set-up fees.

If you have a business in the Texas area, our invoice factoring offices would be happy to assist you. See how invoice factoring with Riviera can help your business reach its full potential.

Recent Fundings

TEXAS

Facility Consulting

Factoring Line

$250,000

Facility Consulting – Texas

× Close

This company found Riviera in their quest for a solution to their cash flow issues. Their first year in business was going well, but their growth potential was being held up because their customers paid in 30-60 days and they had to pay vendors and employees long before that. Riviera’s factoring services have allowed the company to meet their financial obligations and feel confident taking on new business.

TEXAS

Wind Turbine Repair & Maintenance

Factoring Line

$250,000

Wind Turbine Repair & Maintenance – Texas

× Close

A young company in the renewable energy field found themselves in a cash flow predicament. They provide specialized maintenance services for wind turbines and as business opportunities were increasing, so was their payroll. They needed to bridge the gap between billing for completed work and receiving payment 30-60 days later in order to cover their regular payroll. Another client referred them to Riviera and they now have a $250,000 factoring line to provide them the working capital they need to continue growing their business.

TEXAS

Pipeline Inspection

Factoring Line

$250,000

Pipeline Inspection – Texas

× Close

Another lender referred this company to Riviera because their existing line of credit was not sufficient to meet their growth needs. Riviera set up a $250,000 factoring line which has allowed the client to seek larger projects and expand their business.

Our Process

STEP 1

Apply

Complete form & become a Riviera client

STEP 2

Service

You deliver your products or services

STEP 3

Send

Send your invoices to Riviera Finance

Follow Us