Invoice factoring gives businesses the power to ensure growth without diluting equity or incurring debt.

WHAT IS INVOICE FACTORING

Understanding What Invoice Factoring Is and How It Works

Invoice factoring is the purchase of accounts receivable for immediate cash. Invoice factoring gives businesses the power to ensure growth without diluting equity or incurring debt. After invoices are submitted and verified, they are funded by Riviera Finance within 24 hours.

Your business needs working capital in order to take on new business, grow your business or manage everyday expenses. It’s tough to build your business when you’re waiting on your customers to pay for 30, 60 or 90 days.

Riviera Finance allows you to get paid right away. Instead of waiting for idle invoices to get paid, send them to Riviera to get paid right away. Once we buy your invoices, we become your accounts receivable department.

Take control of your cash flow with invoice factoring with Riviera Finance.

Watch the short video above that explains what is factoring and how it can help your business’s cash flow and give you access to working capital in as little as 24 hours.

Benefits of Invoice Factoring

Riviera Finance works with a variety of companies in the US and Canada to help them maintain cash flow and meet weekly financial demands.

Immediate Cash

Our process is built around immediate response to client needs, and the best cash turn around in the industry.

Quick Credit Checks

Receive Credit Checks on Your Customers

Low Risk

Competitive Rates and No Hidden Fees

Financial Freedom

No Debt is Created

Bad Debt Protection

Riviera takes on all the credit risk!

Get Started

Complete the form for a Free Consultation.

Unlock the Benefits of Invoice Factoring for Your Business

Now that we have answered what is invoice factoring, discover the benefits of factoring invoices with Riviera Finance really boil down to adding profit to your bottom line. Before you factor, make sure you can take advantage of the features of invoice factoring and leverage them into value:

Take on Additional Business

Most of our invoice factoring clients can do more business if they have better cash flow. How this works depends on your industry and your market. Some real examples are:

- Improving or increasing marketing

- Saying “yes” to customers who demand credit terms

- Investing in income-producing assets–people and equipment

- Eliminating supplier constraints

- Shifting manpower from collection to marketing and production

Reduce Expenses

Many of our invoice factoring clients actually reduce expenses by outsourcing credit and administration to Riviera, and by leveraging their healthy cash position. The most common ways include:

- Eliminating bad debt with Riviera’s credit guarantee

- Reducing collection and administrative expenses

- Receiving cash discounts from suppliers

Improve your Financial Conditions

Factoring invoices for cash enables some businesses to “get current” or reduce strains caused by tight cash flow. It also improves their own credit rating. Here are some examples we frequently see:

- Staying current with suppliers and creditors

- Establishing payment terms with suppliers, further improving cash flow

- Meeting regular payroll obligations

- Bringing payroll taxes current

Why Wait?

Start getting paid immediately

How Can Your Company Benefit by Factoring Invoices?

Every company has a unique situation. Before signing up to factor, it’s important to understand how our invoice factoring services can increase your business, reduce your expenses, and improve your financial situation.

Watch the video to the right to see an example of how factoring can help your business and unlock working capital in as little as 24 hours.

If you’re ready to start factoring invoices, click on the get started button below and fill out an online form to get connected with one of our business representatives. They are waiting to help your business.

How Invoice Factoring Works

Industries Served by Factoring Companies

Invoice factoring is an option for most B2B businesses. Start-ups, small and medium-sized businesses

most commonly benefit from factoring in these industries.

Different Types of Invoice Factoring

Let’s explore the different types of factoring, so you’ll know exactly what to look for when choosing a factoring company to partner with.

Non-Recourse Factoring

With non-recourse factoring, if your customer doesn’t pay their invoice due to credit reasons, such as filing for bankruptcy, the factoring company takes the loss instead of your business. You will not be required to pay back the advance to the factoring company. You could think of non-recourse factoring as a business cash flow solution and customer credit insurance all in one.

For reference, Riviera Finance provides non-recourse factoring.

Recourse Factoring

If your customer doesn’t pay the invoice that was factored, for any reason within, generally within 90 days, you are required to repay the recourse factoring company the amount that was advanced. Therefore, recourse factoring does not protect a company from bad-debt. For reference, most factoring companies offer this type of invoice factoring.

Related: Factoring Costs and Benefits

Spot Factoring

Spot factoring allows you to factor a single invoice. For example, if you have a large invoice that needs to be paid immediately, a spot factor can provide funding for just that one invoice.

Whole Ledger Factoring

Whole ledger factoring requires you to factor all of your invoices with the factoring company. This may not be ideal for businesses that only experience payment delays with a few customers, as it involves factoring every invoice, regardless of the payment reliability of all your clients.

Riviera Finance does not require you to factor all of your invoices. Riviera clients choose which invoices they would like to factor.

Our Process

STEP 1

Apply

Complete form & become a Riviera client

STEP 2

Service

You deliver your products or services

STEP 3

Send

Send your invoices to Riviera Finance

STEP 4

Get Paid

Riviera verifies & pays you within 24 hours

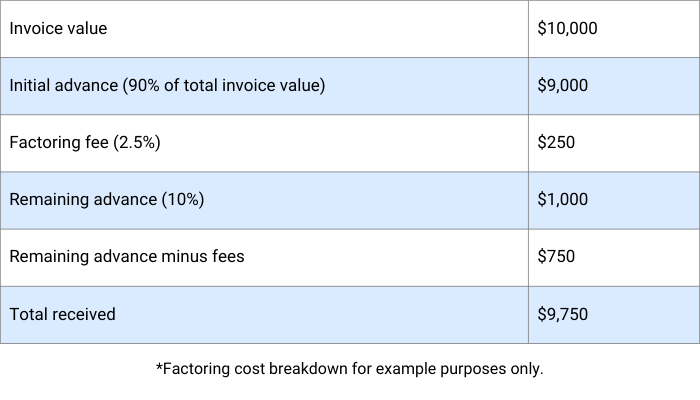

Invoice Factoring Example

Businesses can wait 30, 60, or sometimes 90 days to be paid for goods or services. Here’s a detailed example of how invoice factoring works with real numbers:

- You invoice your customer. You provide a service to another business, generating a $10,000 invoice.

- You sell your invoice to a factoring company. The factoring company agrees to buy your invoice and advance you 90% of the total value, or $9000.

- Factoring company assumes responsibility for your invoice. The company collects repayment from your customer.

- The factoring company charges a fee for service. For example purposes only, we will assume the customer pays the invoice in 30 days and the factoring company charges a fee of 2.5%. So in this example, the factoring fee deducted will be 2.5% of $10,000, or $250.

- The factoring company sends you the remaining balance, minus fees. Now that your customer has paid, the factoring company will send you the remaining 10% of the invoice amount, or $1,000, minus the $250 fee. You’ll receive a total of $750 back. This means at the end of the process, you’ve received $9,750 out of the total invoice amount of $10,000

Common Questions About Invoice Factoring

What is invoice factoring and how does it work?

Invoice factoring is a type of financial service where you “sell” some or all of your company’s outstanding invoices to a third party as a way to increase working capital. A factoring company will pay you immediately at the time of invoicing, then collect payment directly from your customers.

What are the disadvantages of invoice factoring?

Factoring, like any financial service, will cut into your profit margin. So before you decide to factor, you should make sure the benefit outweighs the cost. Additionally, some factoring companies have long agreements with hidden costs, so you need to be sure you carefully review any agreement you sign and understand all associated costs.

Riviera Finance has always chosen to have straight forward term sheets and pricing with no hidden fees.

Is invoice factoring good?

Improving cash flow increases your business’s chances of success, as poor cash flow is a common reason many businesses fail. Invoice factoring can help maintain healthy cash flow, but it’s important to use it wisely.

How much does invoice factoring cost?

Generally, a factoring company will charge 1-5% (this is considered the “factoring fee”) of the total invoice value, depending on variables such as your factoring volume, invoice size, risk profile, and client credit. If your company factors higher volumes and works with trustworthy clients, your fees will generally be lower.

How long does it take to factor an invoice?

The factoring process is simple: you submit unpaid invoices for completed work. The factoring company verifies invoices and advances you the funds within 24 hours.

What Our Customers Are Saying

View All TestimonialsRecent Fundings

ILLINOIS

Staffing

Factoring Line

$300,000

Staffing – Illinois

× Close

This healthcare staffing business had been operating for a year and was looking to increase working capital to support rapid growth. Initially, they got an MCA loan. The decision caused a reduction in working capital because of high monthly payments and hindered their growth.

Their accountant suggested Riviera to support their working capital needs and future growth with Accounts Receivable Factoring. Riviera Finance was able to payoff the existing loan and provide needed working capital to meet their growing payroll.

COLORADO

Transportation Broker

Factoring Line

$700,000

Transportation Broker – Colorado

× Close

Established in 2005, this company needed to maximize cash flow to handle seasonal increases in load volume and a surge in new contracts. Riviera Finance quickly established a full-service factoring line which provides free credit checks and converts invoices to cash within 24 hours. The client is funded twice a week on a non-recourse basis. As a value-add, Riviera Finance prepares and mails checks to the client’s carriers. Between April and June, this client doubled its factored volume and continues to experience healthy growth.

FLORIDA

Specialty Wholesaler

Factoring Line

$350,000

Specialty Wholesaler – Florida

× Close

A specialty wholesaler that distributes exclusively to assisted living facilities and the health club industry was looking for a way to grow their business without creating debt. They also needed to find a way to extend large credit lines to customers without risking personal assets. Riviera offered them a way to accomplish both of these objectives. Now after factoring for over a year with Riviera, this company relocated to a state-of-the-art warehouse facility. They are on target to do $5MM in sales, easily meeting payroll and forming a wholesale subsidiary to increase business and profit margins further.

Follow Us