October 1, 2024

Recourse vs Non-Recourse Factoring

Invoice factoring is a type of alternative financing that can help businesses obtain the funding they need. There…

September 14, 2024

How to Reduce your Business’s Risk of Bad Debt

Bad debt can be a significant challenge for any business, threatening cash flow and profitability. It refers to…

August 21, 2024

Top 5 Benefits of Cell Tower Factoring

If you own a cellular tower maintenance company, having a reliable client base is great for your business.…

July 29, 2024

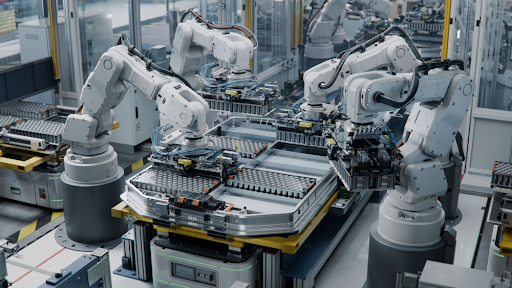

6 Reasons Manufacturing Companies Use Factoring

Manufacturing businesses produce countless products in hundreds of industries. If you are a manufacturer, one problem you may…

June 27, 2024

CHIPS Act Recap

The Commerce Department recently announced plans to provide significant funding to companies engaged in semiconductor manufacturing and other…

June 13, 2024

7 Key Benefits of Medical Receivables Factoring

Medical invoice factoring, or medical receivables factoring, is a financing method where a business sells its unpaid invoices…

May 28, 2024

7 Essential Tips For Starting a Staffing Agency

Staffing agencies are essential in our fast-changing economy. You play the role of matching qualified candidates with the…

March 28, 2024

The History of Factoring

Invoice factoring is a type of business financing that's an alternative to conventional business loans. A factor buys…

October 4, 2023

Advantages of Small Business Invoice Factoring

Slow cash flow can cause real problems for small businesses. When clients are slow to pay, it can…

September 6, 2023

4 Ways to Recession-Proof Your Staffing Company

As with many industries, temporary staffing agencies have faced a variety of challenges in recent years. The COVID-19…

Follow Us