If you run a staffing agency, you understand the importance of cash flow. Waiting for customers to pay their invoices can create painful gaps in your cash flow. One solution to this common problem is invoice factoring, a type of financing where you get paid for your invoices immediately rather than having to wait for clients to pay.

Top Benefits of Invoice Factoring for Staffing Agencies

1. Factoring Helps You Grow Your Business

Invoice factoring for staffing agencies is more than a way to help you survive. It can help you thrive and grow. As you enjoy more reliable cash flow, you can focus your resources on marketing and promoting your agency. When you’re struggling with cash flow issues, all you can do is tread water. Invoice factoring gives you the steady influx of cash you need to improve and expand your staffing agency.

2. Factoring Helps You Get Consistent Cash Flow

Lack of cash flow can seriously harm your business. Steady cash flow is necessary for running your agency on a daily basis. As with any type of business, staffing agencies have their ups and downs. Yet even when business slows down you still have to meet your financial obligations such as paying employees and keeping your office running. Invoice factoring helps you get over rough patches by providing you with consistent cash flow.

3. Fast and Simple Type of Financing

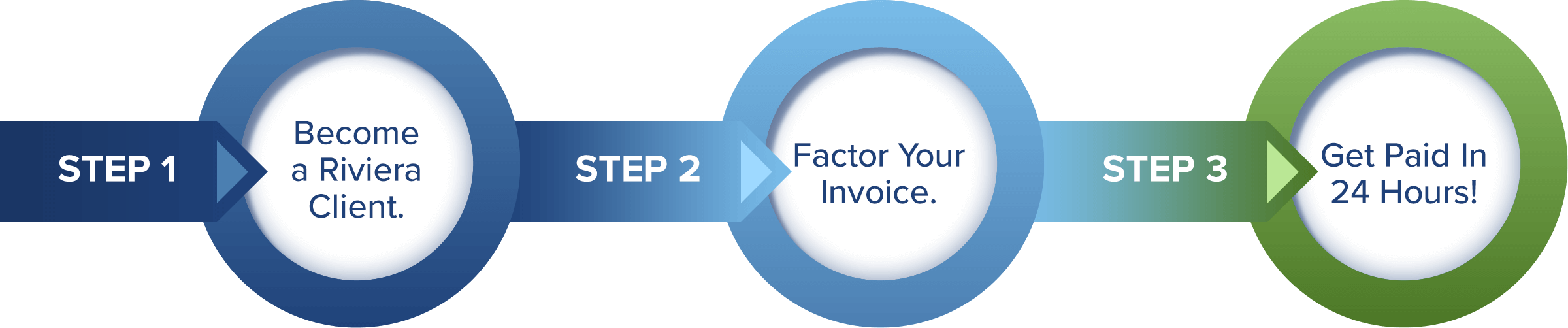

Applying for a business loan is a complicated and drawn out process. It can take weeks or months to get approved and actually get the funds you need. Invoice factoring, by contrast, is fast and simple. Once you’re approved and submit unpaid invoices, you get funds deposited into your account right away. Banks limit the amount you can borrow based on criteria such as your credit score and how long you’ve been in business. With factoring, you can receive unlimited funds based on your receivables.

4. More Favorable Terms Than Traditional Financing

Many businesses that have trouble obtaining bank loans are able to qualify for factoring. Additionally, you’ll find that the terms and conditions are more beneficial to your long-term financial health. For one thing, invoice factoring doesn’t force you to take on additional debt. You aren’t taking out a loan but simply leveraging your own invoices. This means you don’t need to put up collateral such as real estate or equipment. Many businesses find that factoring is a more favorable and less stressful type of financing compared to bank loans.

5. Factoring Companies Also Provide Back Office Support

Aside from financing, factoring companies help you save time and run your office more efficiently. They offer assistance in areas such as collections, accounts receivable reporting and customer relationship management. When you work with a reputable factoring company, you get valuable help running your back-office tasks so you can devote more time to essential tasks such as recruitment. This is another way that invoice factoring for staffing agencies can help your business thrive and grow.

How Invoice Factoring Helps Staffing Companies

If you’re looking for a way to grow your business and improve your cash flow, factoring is a type of financing you should consider. To learn more about invoice factoring for staffing agencies, contact Riviera Finance.

Why Choose Riviera Finance as Your Invoice Factoring Company

Once you understand the benefits and learn how non-recourse invoice factoring works, you may be anxious to get started. However, while there are many financial institutions that offer invoice factoring services, if you want to get the full benefits you need to choose the right invoice factoring company to work with.

It’s crucial to choose an experienced, reliable company that you can depend on. Riviera Finance has been a leading invoice factoring company for more than 50 years and works with B2B companies in various industries across the nation. Riviera factors companies from start-up to revenue of $2 million per month.

You Might Also Be Interested in the Following Articles:

*This article was originally published in September 2018 and was updated in July 2022.