When someone needs business financing, the first type of funding they usually consider is a bank loan. However, invoice factoring can be a good alternative with many advantages. Let’s look at some of the key differences between factoring and a bank loan.

When someone needs business financing, the first type of funding they usually consider is a bank loan. However, invoice factoring can be a good alternative with many advantages. Let’s look at some of the key differences between factoring and a bank loan.

Bank Loans: Why They Don’t Work For All Businesses

For most, a business loan offered by a bank is the most familiar type of financing. If you need business financing, it’s worth considering a bank loan. However, this type of loan comes with several potential drawbacks.

Eligibility

Banks have fairly strict criteria to qualify. They favor businesses with an established history that have collateral to back the loan. Bank loans can be difficult to secure if you’re a startup or smaller business without a strong credit rating.

Lengthy Application Process

It can take quite a while to get a bank loan. You will have to provide a business plan, along with financial statements & forecasts, and go through a lengthy underwriting process to be considered as a candidate for a loan. Once you apply, you may have to wait months for a decision. During this period, you won’t know whether your funding is on the way or not.

Limits to Funding

Even if the bank approves your loan, the amount may be restrictive to your business’s future growth. Banks will base the loan amount on your history and its own risk assessment process. Once again, this does not favor small businesses and startups.

Debt is Created

With a loan, you repay the principal and interest over time. This can place financial pressure on you for years to come.

The Benefits of Invoice Factoring?

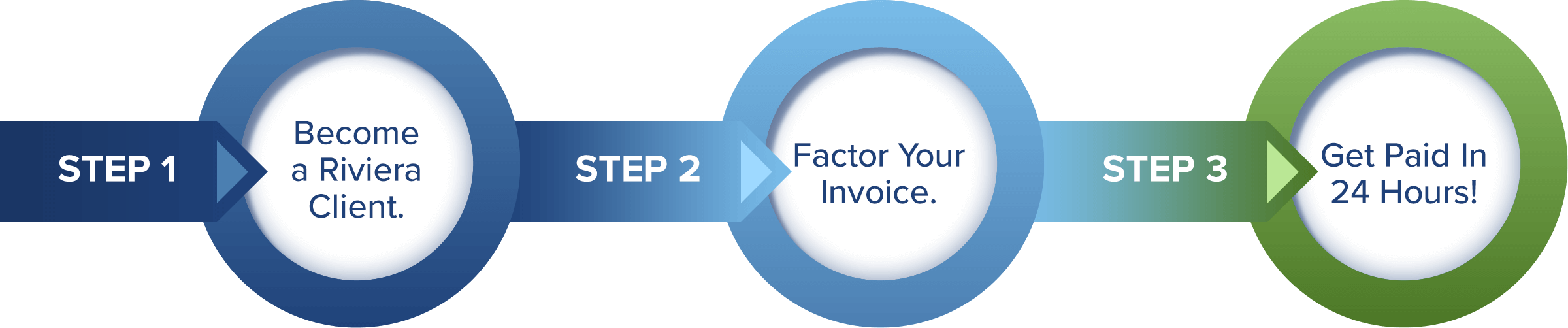

Invoice factoring is an alternative type of financing that can help businesses boost their cash flow. This process lets you collect payment on invoices immediately. The factoring company pays you at the time of invoicing and your clients pay them, usually within 30-60 days according to their payment terms. Factoring is used in many industries, including transportation, hospitality, IT, energy, temporary staffing, business services and many others. Here are some benefits of invoice factoring, especially as compared to bank loans.

- Fast approval. In contrast to a traditional business loan, it’s quick and easy to apply for factoring. Better still, you can be approved and receive funding in less than a week.

- Approval is based on your customers’ creditworthiness. Rather than looking at your credit, a factoring company considers the credit risk of your clients. Startups, as well as more experienced businesses, are eligible for factoring.

- Funding that can grow with your business. As your business grows, your factoring line can grow with you. Unlike banks, a factoring company won’t place caps on funding based on the credit history of your business.

- No debt to repay. Unlike loans, with invoice factoring, you don’t take on any debt. Fees are deducted with each transaction, so no matter how many invoices you factor, you’ll never accumulate debt.

Bank Loans vs Invoice Factoring: Which is Better for Funding Your Business?

When choosing how to fund your business, you have to consider your circumstances and needs. Both business loans and factoring are viable funding methods. However, invoice factoring is especially attractive if you find that it’s hard to qualify for a bank loan or you want to avoid some of the limitations of borrowing money.

Riviera: Your Best Choice for Invoice Factoring

If you’re seeking factoring services for funding your business, Riviera Finance has half a century of experience serving clients in many industries. To find out more about how invoice factoring can help your business, schedule a free consultation with Riviera Finance.