One decision every business has to make is whether or not to extend credit to customers. Providing customers with credit allows them to obtain goods and services now while paying for them later. At the same time, you have to be careful to do this in a way that’s responsible and doesn’t harm your cash flow. Let’s look at how to extend credit in a way that’s beneficial to both businesses and their customers.

Benefits of Extending Credit to Customers

Why should you even consider extending credit to customers? At first glance, it may seem like a risky endeavor. However, it’s a practice that can help your business in several ways.

1. Generate More Sales

The best reason to consider extending credit to customers is that it makes your business more attractive to customers. People are often more willing to buy something if they can get it on credit.

2. Gain an Edge Over the Competition

When you extend credit to your customers, you’re offering an advantage that your competitors may not be able to match. This is a good way to differentiate yourself and build long-term relationships with customers. This tactic is most common in B2B industries such as legal services and transportation.

3. Enhance Your Reputation

Having a policy of extending credit can also enhance your reputation as a successful business. Since the ability to extend credit implies a certain amount of financial stability, it can serve to attract even more business and enhance your standing in the business community.

Benefits of Choosing Riviera as Your Factoring Company

Speed of Delivery

Our process is built around immediate response to client needs, and the fastest cash turn around in the industry.

Dependable Service

We have 125 skilled employees at key locations across the U.S. approving credit, processing invoices, and wiring.

Maximum Cash Advances

We pay the highest cash advances in the industry and strive to fund our clients without holding reserves.

Convenience

Riviera’s Online Account Management system, your accounts are available online 24/7.

Simplicity

Simple applications, no set-up fees, and no long-term contracts make getting started with Riviera easy.

Personal Service

Hearing what our clients need and consistently delivering it builds trust and a satisfied customer relationship.

Diversity

To best serve our diverse client base, Riviera has dedicated support, in your time zone, that speak your language.

Financial Stability

You can feel secure knowing that funds are always available for your next funding.

Why Wait?

Start getting paid immediately

Drawbacks and Complications of Extending Credit

While there are certainly advantages to extending credit to customers, there are also some possible problems that can arise with this practice. These include:

1. Dealing with Late-Paying Customers

While most customers pay on time, there are those who are less responsible or who find themselves unable to pay. It’s always a hassle dealing with slow-paying customers who can’t or won’t pay on time.

2. Resources Allocated to Collections and Accounts Receivable

Once you start extending credit to your customers, you have to allocate the necessary manpower and resources to handle this extra work.

3. Effect on Cash Flow

The more credit you extend, the more limited your immediate cash flow. If you don’t plan properly, this can limit your ability to meet your own financial obligations and limit business growth.

These are some of the problems that can come up when you extend credit to customers. However, this should not discourage you from initiating the practice. There are pros and cons to every business decision. If you take the right precautions and establish transparent and responsible measures, you can minimize the problems and enjoy the benefits of extending credit.

How to Extend Credit to Customer in 4 Steps

Now let’s look at some tips on how to enjoy the benefits of extending credit to your customers while avoiding the downside.

1. Vet Customers Carefully

Make sure you thoroughly investigate customers’ credit history before extending them credit. Start by pulling credit reports from one of the major credit reporting bureaus. Extending credit to the wrong customers is probably the mistake that will cause you the most problems.

2. Set a Clear Policy

Makes sure your customers understand the terms of when they have to make payments, the amount of interest and penalties for late payments.

3. Be Flexible

You don’t have to offer the same terms to every customer. For example, you might start off customers with 30-day terms while offering long-term customers 60 or 90-day terms.

4. Stay Organized

Use invoicing software to track invoices. Using software such as Quickbooks, Norton Small Business or Freshbooks lets you stay organized and track all of your invoices.

If you follow these guidelines, you have a better chance of having a smooth relationship with the credits for whom you extend credit. There’s another practice, however, that can make the whole process even easier for you.

Find a Location Near You

Companies across the United States and Canada depend on Riviera Finance to deliver reliable local service to support their daily cash flow needs. Wherever you are, we have an invoice factoring company office with experienced professionals to serve you.

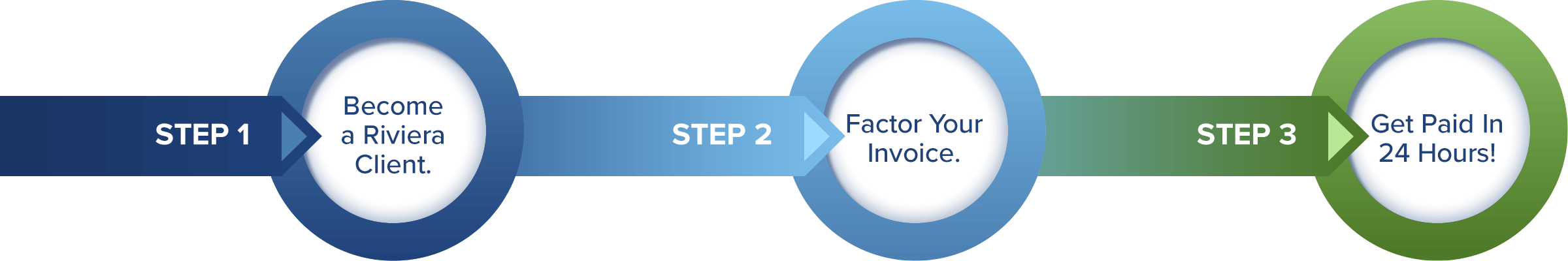

Use Invoice Factoring to Help with Cash Flow

Invoice factoring can help you avoid the cash flow problems that often accompany extending credit to customers. With invoice factoring, you’re able to collect advances on outstanding invoices from factoring companies. The factoring company then collects payments from your customers while you fulfill orders as usual. This is a way to reap the benefits of extending credit without sacrificing cash flow for your own business.

Riviera Finance has been a recognized leader in business financing since 1969. They offer flexible invoice factoring services to all kinds of businesses to help with growth and cash flow. To learn more about extending credit to your customers, Contact Riviera Finance Today!

*Originally published on May 2018 and updated on January 2021.