Which Funding Is Right for You?

Cash is king. For any small business owner, this isn’t just a saying, but a fundamental truth. A steady and reliable cash flow is the lifeblood of your operation, enabling you to manage payroll, pay suppliers, invest in new equipment, and fund strategic growth. When cash flow becomes unpredictable, even a profitable business can face significant challenges. This isn’t a sign of failure but a common growing pain.

Fortunately, there are financial tools designed to help you bridge these gaps. Two of the most common solutions for small businesses are a line of credit and invoice factoring. Both can provide critical access to working capital, but they function in fundamentally different ways. Understanding these differences is the key to choosing the right financial partner for your business’s unique needs.

Let’s look at the pros and cons of a line of credit vs. invoice factoring to help you decide which is best for your business.

What Is a Small Business Line of Credit?

A small business line of credit is a type of revolving credit account offered by a bank or an online lender. Think of it as a flexible credit card for your business. You are approved for a specific credit limit, such as $50,000. You can draw funds from that account as needed, up to that limit. You only pay interest on the amount you have borrowed. As you repay the funds, your available credit is replenished, and you can draw on it again.

This type of financing is typically used for managing short-term expenses. Common use cases include purchasing inventory to prepare for a busy season, covering unexpected operational costs, or bridging revenue gaps during a slow period. It provides a safety net for business owners who anticipate fluctuating cash needs.

However, qualifying for a line of credit can be a significant hurdle. Lenders base their decision primarily on the business’s creditworthiness. This means they will conduct a rigorous review of your business and personal credit scores, as well as analyze your financial statements and cash flow history. They may also require that you have been in business for a specific number of years.

The application process can be lengthy and may require you to provide collateral to secure the line. All of this makes a business line of credit challenging for many businesses. If you haven’t been in business long or have imperfect credit, you may not qualify.

What Is Invoice Factoring?

Invoice factoring, also known as accounts receivable financing, is a financial service that converts your unpaid invoices into immediate working capital. Instead of waiting 30, 60, or even 90 days for your customers to pay, you can sell your invoices to a factoring company. The factoring company advances you a large percentage of the invoice amount, often up to 95%, within a day or two. They then collect the payment directly from your customer. Once the invoice is paid in full, the factoring company sends you the remaining balance minus a small service fee.

Related: What to Consider When Selecting an Invoice Factoring Company

Crucially, invoice factoring is not a loan. You are not taking on new debt or adding a liability to your balance sheet. You are simply accessing the value of money you have already earned. This makes it an ideal solution for businesses that have long payment cycles with their clients, such as those in the trucking, manufacturing, or staffing industries. It is also perfectly suited for businesses experiencing rapid growth, where sales are outpacing the cash on hand needed to fulfill new orders.

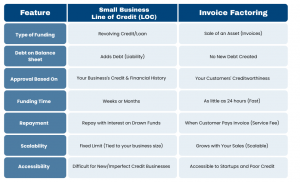

Key Differences at a Glance

While both options improve cash flow, their underlying mechanics are very different. The choice between them often comes down to what your business can qualify for and what kind of financial structure suits you best.

Small Business Line of Credit

- The funding source is a bank or financial institution

- LOC approval is based on your business credit score and financial history

- You repay the borrowed funds with interest

- Adds debt to your balance sheet

- The approval process can take weeks or months

Invoice Factoring

- The funding source is a factoring company

- Approval is based on the creditworthiness of your customers

- The advance is paid off when your customer pays the invoice

- Does not create new debt

- Often approved and funded within a couple of days

Pros and Cons of Each Option

To make an informed decision, it’s important to weigh the advantages and disadvantages of each financial tool.

Line of Credit: Pros

- Flexibility. You can draw and repay funds as needed, giving you control over your borrowing.

- Revolving Access. Once established, the line of credit is available whenever you need it.

- Potentially Low Rates. For highly qualified borrowers with excellent credit and strong financials, the interest rates can be very competitive.

Line of Credit: Cons

- Difficult to Qualify. Stringent requirements for credit scores, time in business, and profitability exclude many small or new businesses.

- Credit-Based. The approval and the credit limit are tied directly to your company’s financial strength.

- Adds Debt. Every dollar you draw is a loan that must be repaid and is recorded as a liability on your balance sheet.

Invoice Factoring: Pros

- Fast Funding. You can convert invoices to cash in as little as 24 hours, providing immediate relief for cash flow gaps.

- No Debt Created. You are selling an asset, not borrowing money. This keeps your balance sheet clean and preserves your ability to seek other financing.

- Scalable with Sales. As your sales grow, the amount of funding available to you grows automatically. This is a powerful feature for expanding businesses.

- Accessible. Approval is based on the financial strength of your customers, not your own credit history. This makes it accessible to startups and businesses with less-than-perfect credit.

Invoice Factoring: Cons

- Service Fee. There is a cost for the service, typically a small percentage of the invoice value.

- Requires B2B Invoicing. Factoring is designed for businesses that invoice other businesses (B2B), not those that sell directly to consumers (B2C).

Choose the Right Solution For You

A line of credit might be the right choice if your business has a long, established history, excellent credit, and predictable expenses.

Invoice factoring is often the ideal solution for businesses that are growing quickly, have reliable customers who are slow to pay, or do not meet the strict criteria for traditional bank loans. If your primary challenge is bridging the gap between invoicing and getting paid, factoring provides a direct and sustainable solution. It allows you to fund operations and seize new opportunities without the burden of debt.

Unlock Your Working Capital

Both a small business line of credit and invoice factoring are valuable tools that can help you manage your company’s finances. The right choice depends entirely on your business’s circumstances, from your credit profile to the nature of your cash flow challenges.

Ready to see how invoice factoring can provide the working capital your business needs – without adding debt? Contact Riviera Finance today for a free, no obligation consultation.

The Riviera Finance Advantage

Riviera Finance has worked with small and medium-sized businesses for more than 55 years in a variety of industries and service areas. Riviera Finance has a team of financial representatives across North America ready to help you get access to working capital to fund new technology, equipment, tools or take on new business.

Our Process

STEP 1

Apply

Complete form & become a Riviera client

STEP 2

Service

You deliver your products or services

STEP 3

Send

Send your invoices to Riviera Finance

STEP 4

Get Paid

Riviera verifies & pays you within 24 hours

Why Wait?

Start getting paid immediately

About The Author

Jacquelyn holds a degree in Business Administration and has over 17 years of experience in the commercial finance industry, including the past 7 years specializing in invoice factoring.