One of the biggest challenges for trucking companies is tracking and managing fuel expenses. There’s no way to predict what fuel prices will be weeks or months from now. Operational costs for companies can also be unpredictable. That’s why it’s crucial for transportation businesses to find ways to reduce costs. Fuel cards can be a powerful tool to help you accomplish this. Let’s look at how they work and share some tips on how to get the most out of them.

Types of Fuel Cards

All fuel cards are similar. They’re all designed to help trucking companies manage fuel expenses, get the best prices, and track spending in real-time. However, beyond this, they fall into a few different categories.

The first distinction is between prepaid and credit-based programs. One functions like a debit card, and the other more like a credit card.

Prepaid Cards: Prepaid cards work like debit cards. You “load” them with cash and pay as you go. These cards don’t require a credit check.

Credit-Based Cards: Credit-based cards work like credit cards for gas, providing users with a line of credit. Like credit cards, they often offer rewards based on spending.

Fuel cards may also be branded or universal. A branded card can only be used at certain gas stations. There are also merchant-branded cards that are only valid at one specific station. Universal cards can be used at any station.

Who Can Use Fuel Cards?

Fuel cards are not made for the general public, though individuals can, to a lesser extent, get similar benefits with credit card rewards programs. Fuel cards are for small and mid-sized trucking companies as well as owner-operators. They are especially helpful for businesses that run regional or long-distance routes. They’re designed for companies that want to have predictable fuel costs and that want to enjoy the same advantages as large carriers.

How Fuel Cards Work

- Drivers go to a participating gas station. If it’s a universal card, they can go anywhere.

- The driver buys gas, using the fuel card to pay the same as a debit or credit card.

- The transaction is recorded, and the appropriate discount is applied.

- The company gets detailed reports on fuel spending.

Benefits of Fuel Cards

There are several key benefits to using fuel cards.

- Discounts: The main reason trucking companies like fuel cards is that they save money. Depending on the card, savings can be as much as 44 cents per gallon, which really adds up for a transportation business.

- Efficient Tracking: Fuel cards make it easy for companies to accurately track how and when drivers buy gas. This allows the business to monitor expenses, preventing overspending and unauthorized transactions.

- Helps with Cash Flow: Fuel cards are billed at regular intervals. This makes the expense predictable and can help businesses manage cash flow more efficiently.

- Enhanced Security: Fuel cards come with features such as spending controls and fraud protection. Fleet managers can set limits on fuel spending.

- Transparent Pricing: Many fuel cards can be used without setup fees or monthly maintenance fees.

Why You Should Consider a Fuel Card

Smaller trucking companies often struggle to enjoy the same fuel discounts as larger carriers. In an industry where profit margins are often narrow, every dollar you spend on fuel counts. Fuel cards can help put you on equal footing with larger competitors.

Aside from savings, convenience is a major reason many companies appreciate fuel cards. You have access to 1,800+ fuel locations around the nation. You can also get cash and check options for better financial control.

What to Look For

When researching fuel discount programs, you’ll find there are many options to choose from. Before signing up, look at these factors.

- What kind of discounts do they offer? This may vary depending on the program and how much you use the card.

- Where can the card be used? Universal cards are always useful. However, merchant cards can be convenient as well if they are valid at fuel stations you use anyway.

- Are there any hidden fees, such as signup or maintenance fees?

- Is the company offering the card reputable?

How Can I Apply?

Applying is simple. Follow these steps.

- Choose a provider. Look for a company that offers significant discounts and benefits. Riviera Finance has two fuel card partners.

- Fill out an application. Most applications require basic business information and details about your fleet.

- Receive approval and activate your card. Once approved, your fuel card is ready to use at participating locations.

Riviera Finance Fuel Card Advantages

If you want to get your fuel card from a financial services company with more than 50 years of experience, consider Riviera Finance. We partner with two trusted fuel card providers to offer trucking companies access to industry-leading fuel discounts. With no hidden fees and significant savings per gallon, a fuel card is a smart decision for any trucking business.

Start Saving on Fuel Today

If you’re looking for a way to cut fuel costs and manage expenses more effectively, Riviera Finance provides the ideal solution. Apply for the TCS Fuel Card today and start saving on every gallon. Contact us online to apply!

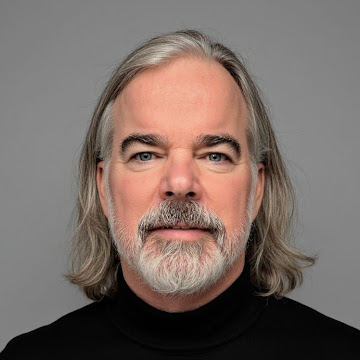

About The Author

Dave Tremblay has over 40 years of experience in the Logistics Industry, including middle and senior management positions as Corporate Logistics Manager for Mattel Toys and The Walt Disney Company, as well as Vice President and President roles at Sterling Logistics and PMT Logistics. Dave currently serves as a Digital/Affiliate Marketing Manager and Logistics Category Expert for Riviera Finance.

Our Process

STEP 1

Apply

Complete form & become a Riviera client

STEP 2

Service

You deliver your products or services

STEP 3

Send

Send your invoices to Riviera Finance