If you’re exploring funding options for your business, understanding UCC filings is essential. These filings play a critical role in how financing is structured, secured, and disclosed, and they can directly impact your ability to access future funding. Whether you’re working with a lender, a line of credit, or an invoice factoring company, UCC filings help define who has a legal claim to your business assets and in what order. Knowing how they work puts you in a stronger position to make informed financing decisions and protect your business.

The Uniform Commercial Code (UCC) establishes a standardized legal framework for commercial transactions across the United States, ensuring consistency and transparency for businesses and creditors alike. UCC filings are formal records submitted by creditors, not business owners, when financing involves collateral. In this guide, we’ll break down what UCC filings are, the different types you may encounter, and what every business owner should know before securing financing.

What You Need to Know About UCC Filings as a Business Owner

What Is a UCC Filing?

If you’re a new business owner or looking for financing, you need to know about the UCC and its filings- forms that are filed and recorded at the Secretary of State when a business obtains financing. UCC forms are not filed by businesses but by their creditors. These filings are called ‘financing statements.’

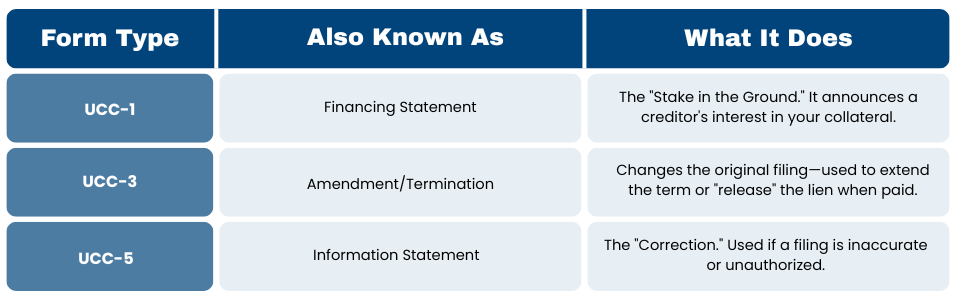

The UCC-1 financing statement, also known as a UCC lien, is the most common type of filing that typically affects small businesses. This is a statement that a creditor will file when providing financing that involves collateral. The UCC-1 gives notice that the creditor has a lien or interest in any collateral business offered to the creditor to secure repayment of the financing. the borrower has put up.

The UCC-3 financing statement is an amendment to a UCC-1. UCC-3 filings can terminate, assign, extend (“continue”), or amend a UCC-1.

The UCC-5 financing statement is an information filing. It can be used as notice on the public record that a previous filing was inaccurate, wrongfully filed, or filed by someone who was not authorized to file.

The Reason for UCC Filings

One of the main purposes of a UCC filing is so that there’s a public record of secured financing that involve collateral. For example, assume that you receive financing from Creditor A. You put up your inventory, equipment, or accounts (i.e., personal property of the business) as collateral. After Creditor A files a UCC-1, any other financier can look up this information and see that your business’s personal property has been put up as collateral. This way, if you try to finance with Creditor B, you can’t put up the same property as collateral, unless Creditor B is willing to take a second position behind Creditor A.

Most UCC-1 liens specify certain assets or possessions that have been used as collateral. However, there are also blanket liens, in which the creditor has rights to “all assets” of the business. UCC filings are valid for five years. They can be terminated sooner or extended (“continued”) based on the mutual financing agreement made between creditor and business obtaining financing.

What You Need to Know About UCC Filings

Small business owners should be aware of any active UCC filings recorded against their business, as these can affect their ability to obtain new business financing. Before a creditor approves a business for financing, they will do a lien search, and if your business has an active UCC-1 filed against it, your ability to obtain new financing may be delayed, subject to negotiation between creditors, or even declined. It will depend on the collateral that each creditor has an interest in. Before allowing a creditor to file a UCC-1 financing statement, you should know what assets will be covered and the conditions of termination.

How UCC Filings Are Used In Factoring

When invoice factoring is used as a financing solution, a UCC filing is a standard and expected part of the agreement. This filing establishes the factoring company’s legal interest in the specific assets being financed, most commonly the business’s accounts receivable. While UCC filings are often misunderstood, they are not inherently restrictive. Instead, they provide transparency and protect both parties by clearly defining which assets are tied to the financing arrangement.

At Riviera Finance, UCC filings are structured to minimize limitations on your business. In most cases, the filing applies only to your accounts receivable and assets directly related to those receivables, leaving equipment, vehicles, and other business assets unencumbered. This approach gives you greater financial flexibility and helps preserve your ability to pursue additional financing options, such as equipment loans or leasing, when needed.

Invoice factoring also supports stronger cash flow and long-term financial health without adding debt to your balance sheet. Because factoring is not a loan, it does not negatively impact your credit score, however the UCC filing itself will appear on a business credit report (like Experian Business or D&B). Instead, it allows you to access immediate cash for invoices you’ve already earned, helping you cover payroll, manage expenses, and pay down existing obligations more quickly. Over time, consistent cash flow and responsible financial management can put your business in a stronger position to qualify for future funding and growth opportunities.

Unlock Reliable Cash Flow Today

If slow-paying customers are creating cash flow challenges, invoice factoring may be the right solution. Contact Riviera Finance to learn how factoring, and transparent UCC filings, can support your business with consistent, reliable working capital.

*This article was originally published in 2019 and has been updated for 2026.

Benefits of Choosing Riviera as Your Factoring Company

Speed of Delivery

Our process is built around immediate response to client needs, and the fastest cash turn around in the industry.

Dependable Service

We have 125 skilled employees at key locations across the U.S. approving credit, processing invoices, and wiring.

Maximum Cash Advances

We pay the highest cash advances in the industry and strive to fund our clients without holding reserves.

Convenience

Riviera’s Online Account Management system, your accounts are available online 24/7.

Simplicity

Simple applications, no set-up fees, and no long-term contracts make getting started with Riviera easy.

Personal Service

Hearing what our clients need and consistently delivering it builds trust and a satisfied customer relationship.

Diversity

To best serve our diverse client base, Riviera has dedicated support, in your time zone, that speak your language.

Financial Stability

You can feel secure knowing that funds are always available for your next funding.

Why Wait?

Start getting paid immediately

About The Author

Dave Tremblay has over 40 years of experience in the Logistics Industry, including middle and senior management positions as Corporate Logistics Manager for Mattel Toys and The Walt Disney Company, as well as Vice President and President roles at Sterling Logistics and PMT Logistics. Dave currently serves as a Digital/Affiliate Marketing Manager and Logistics Category Expert for Riviera Finance.