If you’re looking for non-traditional financing for your business, invoice factoring is one of the most effective solutions worth considering. Getting cash for your invoices immediately rather than having to wait for clients to pay boosts your cash flow, helping you meet expenses and invest in your business. You may be wondering what qualities to look for in an invoice factoring company. The following are some important points to consider.

If you’re looking for non-traditional financing for your business, invoice factoring is one of the most effective solutions worth considering. Getting cash for your invoices immediately rather than having to wait for clients to pay boosts your cash flow, helping you meet expenses and invest in your business. You may be wondering what qualities to look for in an invoice factoring company. The following are some important points to consider.

What Types of Factoring Services Do They Offer?

When applying for invoice factoring, you should understand the type the company offers.

There are two main types: recourse and non-recourse factoring. In recourse factoring, you are responsible for buying back any invoices that your clients neglect to pay to the factoring company. In non-recourse factoring, the factoring company purchases invoices outright, and provides a credit guarantee on your customers which minimizes the risk of bad-debt, or non-payment for clients. If your customer does not pay your invoice for credit reasons or goes bankrupt, for example, you are protected and get to keep the advance the factoring company paid you for that unpaid invoice.

Another distinction you should know is between invoice factoring and accounts receivable financing. With accounts receivable financing, you are borrowing money against unpaid invoices. You are actually receiving a line of credit that’s tied to your invoices. You will have to repay this whether your clients pay the invoices or not. Accounts receivable financing is closer to recourse factoring in that, in both cases, you are ultimately responsible for any unpaid invoices. Non-recourse factoring, on the other hand, protects you from incurring bad debt.

What Are the Terms and Rates?

When considering invoice factoring, you need to be clear about the terms, conditions and rates. Each company has its own rates, which vary according to several factors:

- Your industry

- The average size of your invoices

- The number of invoices you want to factor

- The credit history of your customers

- How long it takes your customers to pay

There’s also the question of whether the company charges flat rates or variable fees. With flat rates, you pay a fixed fee upfront for factoring. With variable rates, the longer the customer takes to pay, the higher the fee.

Read the Factoring Agreement

Make sure you understand the terms before you sign up with an invoice factoring company. You want to be clear on the conditions, any additional fees and any liability you may have for unpaid invoices. Some conditions to look out for are:

- Contract term length and any auto-renew clause

- Monthly minimums you may be required to factor

- What assets will be included in the UCC filing

What Industries Do They Work With?

Invoice factoring benefits many industries. Almost any business invoicing business customers is eligible. However, it’s important that the factoring company you choose to work with understands your line of work, how the billing works, and your customers. So it’s a good idea to check whether an invoice factoring company has experience in your industry.

Quality of Service

If personal service is important to you, then you will want to work with a full-service factoring company that provides you with a dedicated team that will work with you regularly and know you and your business.

Why Riviera Finance is the Right Choice for Invoice Factoring

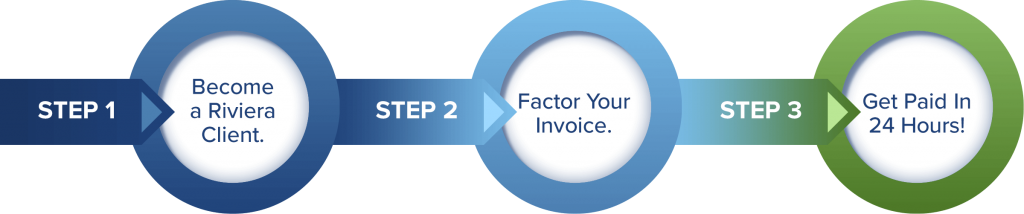

Riviera Finance has been providing factoring services to businesses in many industries for over 50 years. We are a full-service non-recourse factor with simple, transparent fees, no monthly minimums and flexible terms.

For more information about invoice factoring, contact Riviera Finance today.